Executive Summary

Middle East investors in BTU Power Company may be SOL.

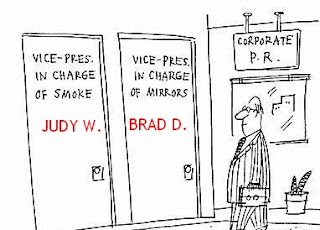

What's this all about?

The QIA petition to Wind-Up BTU Power Company reveals that WAMo never issued Preference Shares to the Middle East investors for their investment in TAPCO. WTF? [

Note: Petitioners don't explicitly state this in their petition. Curious.]

Probably just an oversight by WAMo, Mitsue and the controllers for QGEN, BTU Industries, and BTU Ventures (hint: it's actually the same guy for all 3) regarding the TAPCO investment and the shares they are OBLIGATED to issue.

|

| Where are those BTU Power Company preference shares w/re: the TAPCO investment going in such a hurry? QGEN Ltd. OK, all's well... Any inquiries regarding said preference shares can probably be directed to Simon Firth (Maples & Calder - Cayman Islands) or Tibor Toth, QGEN Ltd. Chief Investment Officer. |

The Numbers...

Value of Middle East investors shares in BTU Power Company:

- WAMo BStimate = US $203.5m

- Value that Paid-Up Shares should have = US $124.8m

- Value of Paid-Up Shares in Middle East investors' hands = US $72m

- Difference between WAMo BS and reality = $131.5m (again, what's a few cents amongst FRIENDS?)

Preliminary Observation

We have to admit that

Wael is a pretty clever fellow if he got the investors money to pay for the Taweelah Asia Power Company ("TAPCO") investment

and never issued them shares reflecting the full paid-up value (

close to $53 million in aggregate). [

Note: The investment was actually made through AGPH, Asia Gulf Power Holding Company.]

Summarizing the shareholder totals from the QIA Petition:

Petitioners Qatar Investment Authority and the Supreme Council for Economic Affairs and Investment, "for themselves, and on behalf of" Qatar Foundation Fund (the "Petitioners") hold a total of 248.2 fully-paid Preference Shares. Supporting Preference Shareholders: Broog Trading Company holds 124.1 Preference Shares, Qatar National Bank holds 49.7 Preference Shares. Dubai Islamic Bank (through the "BTU Power Islamic Portfolio" - actually it's just Wael through the BTU Power Management Company - the "Mudarib") hold an equivalent to 248 Preference Shares. In total, Petitioners and Supporting Preference Shareholders hold 93% of the equity in BTU Power Company.

Let's see...

Supreme Council for Economic Affairs and Investment + Qatar Foundation = 248.2

Broog Trading Company = 124.1

We'll lump all these Qatar sovereign entities as Qatar Investment Authority (QIA) = 372.3

Qatar National Bank (QNB) = 49.7

Dubai Islamic Bank (DIB) = 248 (probably 248.2)

Then, QIA + QNB + DIB = 372.3 + 49.7 + 248.2 = 620.5

Total Preference Shares issued by BTU Power Company = 670.2/0.93 = 720.7

Each Preference Share is priced at $100,000 per the BTU Power Company offering memorandum (dated January 20, 2003)

Finally, 720.7 x 100,000 = $72,064,516 ~

US $72m

As we've documented elsewhere in this blog:

- 1st BTU Power Company drawdown = 10% of the Committed Capital (10% of $290M) = $29M [Note: this was undoubtedly used for working capital since no investments had been made as of June 6, 2003 (first closing of fund).]

- 2nd BTU Power Company drawdown = US $43m

Simple addition = $29 M of unproductive capital (burned up on working capital BS) + US $43m for CPC= US $72m

So...

The paid up value of $72M for Preference Share holders =

Unproductive Capital + CPC + Zero TAPCO

Petitioners believe that their 248.2 Preference Shares reflect a value of US $70m ("the last date for which the Company provided valuation information" ... meaning, this is Wael's BStimate). What does this mean?

Well, Petitioners hold 248.2/720.7 of the equity in BTU Power Company = 0.3444 = 34.45% This would result in a valuation for all of BTU Power Company of $70m/0.3444 = $203.5m

Wael is telling the investors that their investment in BTU Power Company is worth $203.5m

We see another bit of information in the QIA Petition that states that DIB's funded capital in BTU Power Company = $43,007,241 ~ $43m as of December 2008. DIB's equity holding is 248.2/720.7 = 34.45%. Another quick calculation shows that this would amount to a total amount (for funded capital or invested capital in BTU Power Company) of $43m/34.45% = US $124.8m [Note: we had estimated in a previous post that the TAPCO investment totaled $55m. Latest information means TAPCO investment was 124.8 - 72 = US 52.8m]

What does this all mean?

Looks like The Mudarib is on the hook with DIB for US $18m!

Dubai Islamic Bank believes that the BTU Islamic Portfolio reflects a paid-up value of US $48m. Their original maximum commitment to BTU Power Company was US $290m x 34.45% = US $100m. Prior to the repayment of the EBL for AGPH their investment in BTU Power Company was US $72m x 34.45% = US $25m. Therefore, as Mr. Betancourt states in his affidavit, US $75m of DIB's Sharia-compliant money, previously COMMITTED to BTU Power Company, was diverted into BTU Power Company II (hello! Aref Kooheji, how are you doing? You dropped off the "financial world" radar a few months after WAMo sold Meiya Power Company to WAMo and then Standard and paid WAMo a US $8m bonus for burning up US $86m to "manage" US $100m of investors' money. AREF, you'll be featured in many future postings!). DIB's maximum capital commitment was $100m. Prior to the EBL repayment they had already funded that commitment. DIB subsequently paid an additional $43m - $25m = $18m into BTU Power Company (this is what the whole mess of the EBL repayment, according to Mr. Betancourt's affidavit, was about - Aref Kooheji and WAMo were co-architects). Apparently, according to Mr. Betancourt's affidavit, BTU Power Management Company (the "Mudarib") OWES DIB US $18m. Aref Kooheji and Wael Al Mazeedi... like brothers! It's not just a statement, many people were aware of the intensity of this relationship and statements made by WAMo and Aref to that effect.

Dubai Islamic Bank believes that the BTU Islamic Portfolio reflects a paid-up value of US $48m. Their original maximum commitment to BTU Power Company was US $290m x 34.45% = US $100m. Prior to the repayment of the EBL for AGPH their investment in BTU Power Company was US $72m x 34.45% = US $25m. Therefore, as Mr. Betancourt states in his affidavit, US $75m of DIB's Sharia-compliant money, previously COMMITTED to BTU Power Company, was diverted into BTU Power Company II (hello! Aref Kooheji, how are you doing? You dropped off the "financial world" radar a few months after WAMo sold Meiya Power Company to WAMo and then Standard and paid WAMo a US $8m bonus for burning up US $86m to "manage" US $100m of investors' money. AREF, you'll be featured in many future postings!). DIB's maximum capital commitment was $100m. Prior to the EBL repayment they had already funded that commitment. DIB subsequently paid an additional $43m - $25m = $18m into BTU Power Company (this is what the whole mess of the EBL repayment, according to Mr. Betancourt's affidavit, was about - Aref Kooheji and WAMo were co-architects). Apparently, according to Mr. Betancourt's affidavit, BTU Power Management Company (the "Mudarib") OWES DIB US $18m. Aref Kooheji and Wael Al Mazeedi... like brothers! It's not just a statement, many people were aware of the intensity of this relationship and statements made by WAMo and Aref to that effect.

Where in the World are the Preference Shares for BTU Power Company investors?

A couple of observations and some conjecture:

- It's been 3.5 yrs since the EBL repayment for TAPCO took place. Why hasn't Wael Almazeedi issued the shares that rightfully belong to the Middle East investors?

- Are these shares being held "in trust" by an independent party (for example, QGEN Ltd.)? Yeah, Right!!! Independent.... Yeah, sure!

- If these shares reside somewhere else the Middle East investors are screw*d. Maybe this is the reason WAMo, as documented elsewhere, is more than happy to see BTU Power Company liquidated.

- KUDOS again dear Simon Firth, Maples & Calder! You sure know how to keep the money moving around (in the direction of WAMo)!

- Middle East investors: Have you checked your accountants reports?

- In any event.... It'll sure be interesting what WAMo has to say! Maybe he'll update us at his next appearance as the foremost expert in XYZ at the MIT Energy Conference.

The numbers speak for themselves!